That would be fine if for example the credit score is 640 or higher

Their mutual LTV proportion measures up the balance of the mortgage and the HELOC along with your house’s worthy of. In case your house is appreciated on $150,one hundred thousand while are obligated to pay $75,000 on your own home loan, and also you want an effective $31,one hundred thousand HELOC, who give you a combined LTV regarding 70% ($75,000 + $31,one hundred thousand = $105,100000, that’s 70% from $150,000). In case the credit score is leaner, your ount.

Refinancing a mortgage

Mortgage refinancing happens when your change your most recent mortgage having a great another one. Residents can get re-finance to evolve the fresh regards to its mortgage otherwise to obtain dollars.

Can you imagine you borrowed $75,one hundred thousand on your mortgage and your house is worth $150,000. You’ve got a couple options for refinancing. When you need to reduce your monthly mortgage repayments, you can re-finance the $75,000 balance with a good $75,100000 29-year fixed-price home loan. If you want to availableness a number of your house security, you could potentially refinance with a beneficial $one hundred,100 31-season repaired-rates financial. At the closing, you might located $twenty five,100000.

Profile also provides 31-12 months repaired-speed mortgage refinances. Because of this the loan try paid down more thirty years along with your rate of interest never ever transform. Meaning your commission usually remains a similar. not, this doesn’t are escrow repayments to have fees and you may insurance rates, which could alter.

Mediocre Months to shut Mortgage

Contour HELOC also provides closings inside less than five days. You can complete the initially software on line in approximately 5-ten full minutes, and you will generally speaking discover instantly whether or not you’ve been acknowledged. For Financial Refinance, you could finish the first app online in approximately 10 minutes and will close-in a matter of months.

To have HELOCs, Contour uses an automatic Valuation Design (AVM) to assess your own property’s value and that means you don’t need to waiting getting a call at-people assessment. It basics their choice with the comparable conversion process, public research details and you will trends on your regional housing marketplace. Having mortgage refinances, Figure are working along with you so you can plan an out in-individual appraisal together with one monitors.

Once you have come accepted, several of Figure’s HELOC customers could work which have certainly one of the eNotaries. Their eNotary confirms your own label and you will feedback your posts along with you, which you can sign digitally. Only a few areas allow it to be eNotaries, yet not. If that’s the case, Figure will work along with you to prepare an in-person notary meeting.

To have financial refinance, Shape works together with one schedule a call at-people closure yourself or a location that you choose, based what exactly is anticipate your location.

Shape Credit history Minimal

Your credit score are a 3-little finger count one summarizes how good you only pay right back obligations. Ratings are priced between 300 in order to 850, and a rating from 700 or maybe more is regarded as good. Lenders normally have the very least credit score. While underneath the lowest, you’ll want to take some time to improve their score ahead Langston loans of you might be eligible for that loan.

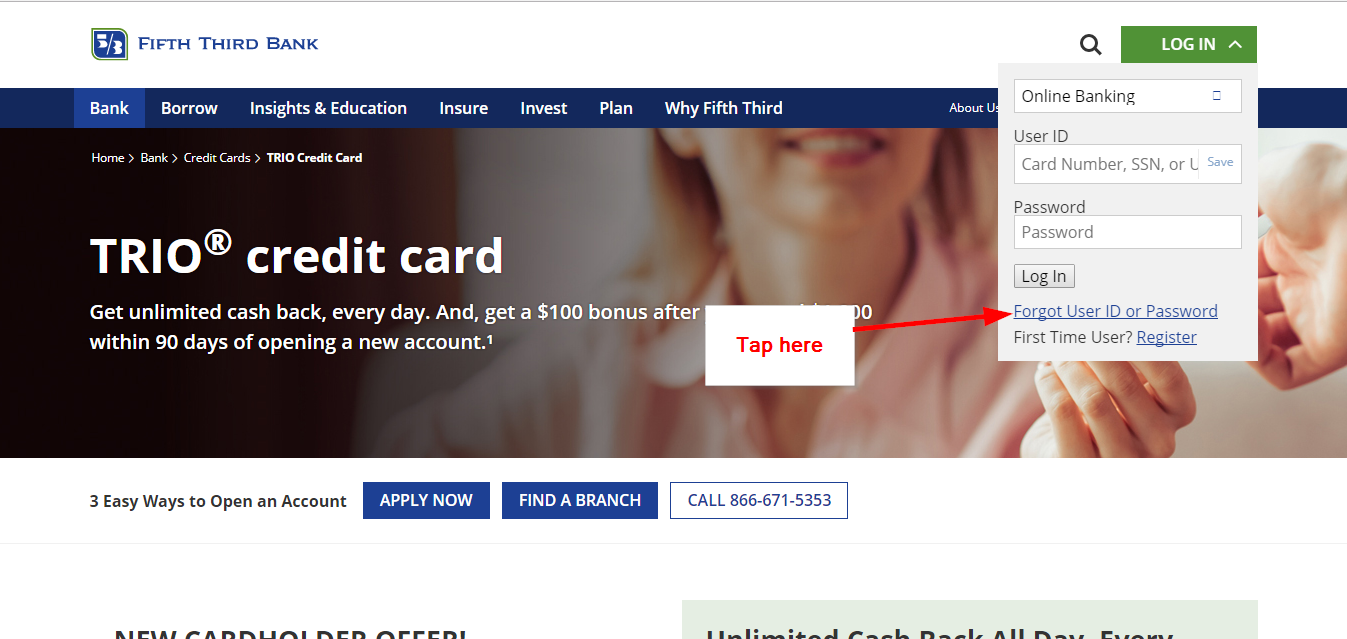

Figure’s credit rating minimal to own financial refinances are 620. The credit score minimum to own HELOCs is actually 640 (720 for Oklahoma for both affairs).

Profile even offers financial obligation-to-earnings (DTI) proportion conditions. Their DTI proportion measures up your monthly debt costs into the pre-tax money. Let’s say you will be making $5,100 30 days in advance of taxation along with $dos,000 four weeks inside month-to-month financial obligation money, which has your mortgage repayment, your brand-new Shape loan percentage, bank card costs, car payments and you can education loan money. This gives your an effective 40% DTI proportion.

Shape requires those individuals making an application for an excellent HELOC getting a DTI proportion away from 50% otherwise quicker, and in many cases, you would like an excellent DTI proportion out-of 43% otherwise faster. For mortgage refinancing, you need a beneficial DTI ratio from 43% otherwise faster.

Leave a Reply