What if You simply cannot Pay Your Financial?

Thank goodness, which Mortgage payment Calculator can help you figure out your own overall month-to-month mortgage repayment and you may printing an entire amortization plan for the facts. You can include expenditures such a home taxes, homeowners insurance, and you will monthly PMI, as well as the loan amount, interest rate, and you may name.

Mortgage loans And your Funds

Financial comes from the fresh Latin mort, or even brand new demise. Believe mortician or mortality. The idea is you pay the financing up until they dies due to the a beneficial-mort-ization of financing (are paid off).

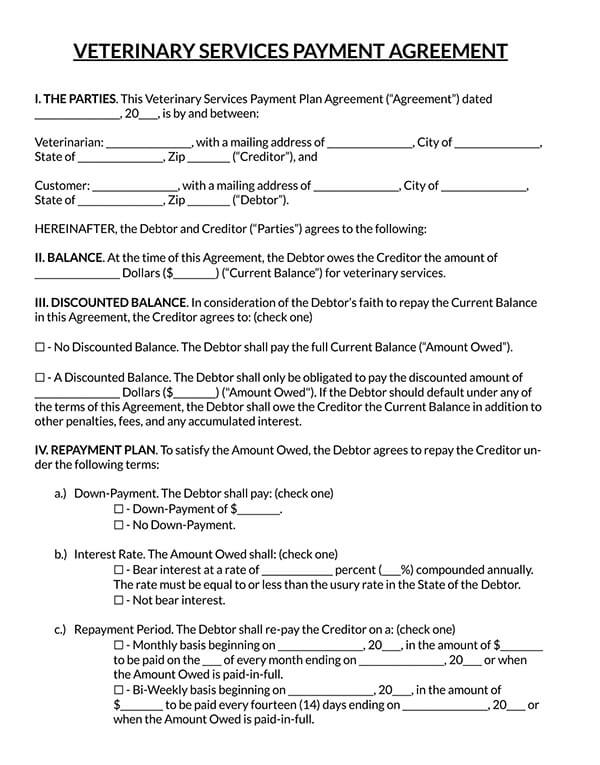

The bank otherwise home loan company financing you a percentage of your house (constantly 80% of cost) that is known as the mortgage-to-well worth commission. The loan loan might be paid off having attract more than a particular time titled an excellent title. For those who, given that borrower, fail to pay the monthly mortgage payments, youre at risk of foreclosure.

Ergo, it is crucial you assess your own mortgage payment in advance to make sure you are able to afford it. Playing with our very own Budget Calculator, discover it’s wise to keep your construction expenditures ranging from twenty-five and you can thirty-five % of your own net gain.

Home loan repayments

When you mortgage a loans Midfield AL home, an advance payment is done. A familiar down payment number is actually 20% of your purchase price. The better the brand new advance payment you create, small extent you will need to loans, and the reduced your month-to-month homeloan payment would be.

Their monthly mortgage payment might be allocated into several fundamental portions: a primary section and you will a destination portion. Depending on how the loan is initiated, your We, a home taxation, and you can home insurance with your mortgage repayment.

By creating an enthusiastic amortization plan using our calculator, viewers the eye portion of your own percentage first exceeds the main bit. Through the years, this will flip-flop. The greater dominating you pay on the higher the percentage of for each fee serious about prominent.

Its advisable that you be aware that you will never feel spending far on the primary of your financial in the beginning. If you want to find out more about how much dominating you need to buy very early rewards here are a few our very own Financial Incentives Calculator and find out from the early rewards methods such as for instance, for the 15 years in the place of 29.

Missing mortgage repayments may lead to the loss of your property. If you are with debt and also you fail to pay their monthly mortgage repayments, your lending company contains the straight to bring your home and you will sell in order to other people to get their money back. Which courtroom processes is called foreclosures.

- When your trouble with paying the financial are short-identity, upcoming is planning to possess a beneficial reinstatement You might spend their bank brand new arrears in addition to later commission or punishment into a night out together you both concur.

- Arrange for a cost plan along with your financial Your financial will recalculate your own payment per month with the addition of the past owed amount to the regular costs. But this 1 simply really works if you have not overlooked of several payments.

- Apply for forbearance whether your earnings suspension system are short term Arrange with your bank to help you temporarily suspend their monthly premiums having a certain time. After the newest forbearance several months, you invest in keep make payment on monthly homeloan payment and aggregate number your missed. Your own lender tend to assess your role for folks who be eligible for the newest forbearance bundle and they will influence this new terms.

- Consult with your bank to find out if it invest in a great loan mod Ask your lender to modify your mortgage words. Could cause that have a much better offer than you already provides.

- Think refinancing For people who overlooked your payments due to low-financial costs, is actually merging the debt. Cautiously evaluate the risks and you can gurus regarding the this option prior to getting people methods.

- Offer your residence Offering your home with little or no gain is superior to property foreclosure. Also going right through a preliminary sales would be worth it depending towards condition you live in. Imagine every solutions.

Conclusions

Of the undertaking on the right legs and you will making certain that you could afford the mortgage payment, you won’t have to worry about the consequences of not paying. Don’t believe you can afford property simply because your own real estate agent states its okay. Its incentives are different from your own personal.

If you’re in home financing commission drama, look for assist via your mortgage lender and you will third parties. Never throw in the towel instead of looking to. You will be astonished what can be worked out for those who merely inquire.

In any event, our Mortgage payment Calculator helps you because of the determining their percentage and you may providing a complete amortization plan for additional study.

Leave a Reply